For African developers and fintech entrepreneurs, entering the global financial ecosystem has often come with major roadblocks — limited infrastructure, banking restrictions, slow compliance processes, and high integration costs.

But the world is changing. Financial inclusion is no longer a dream, and Clauda is at the forefront of making this transformation real.

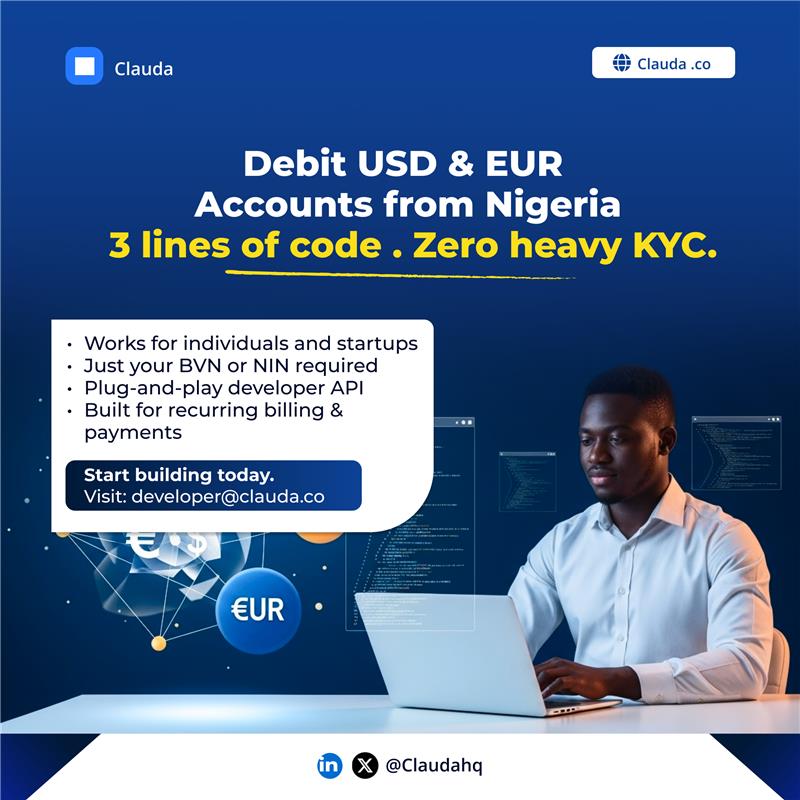

Clauda has built a powerful Direct Debit API that allows startups and businesses in Nigeria and across Africa to initiate secure, reliable debits from USD, EUR, and GBP bank accounts. Whether your customers live in the USA, the European Union, or the UK, Clauda empowers your platform to collect payments efficiently — all through a single, developer-friendly API.

Let’s break down how it works and what it means for the future of African fintech.

Global Payments Have Been Too Hard for African Builders

If you’ve ever tried to collect recurring payments or one-time bank debits from users in the US or Europe while operating from Nigeria or Ghana, you’ve probably encountered one or more of these:

- Lack of access to ACH, SEPA, or Direct Debit rails

- Complex banking integrations across jurisdictions

- Manual KYC and compliance headaches

- Delayed settlements or frozen funds

- A fragmented system of service providers

All of these problems don’t just slow you down — they kill innovation. African developers spend weeks, sometimes months, trying to piece together global payment infrastructure just to support a simple use case like cross-border billing or wallet funding.

Clauda changes that.

Direct Debit APIs for USD, EUR, and GBP

With Clauda, you can now build modern financial products with direct debit capabilities across three major currencies:

- USD (ACH Debit) — Debit customer accounts in the United States via the ACH network.

- EUR (SEPA Direct Debit) — Pull funds from EU customer accounts via SEPA.

- GBP (UK Direct Debit) — Collect payments from customers in the UK through the local Bacs system.

This means if you’re a Nigerian fintech serving global customers — for remittance, savings, digital banking, crypto, or SaaS — you can now debit customer accounts directly from their banks abroad, automatically and compliantly.

No middlemen. No patchwork. Just one unified API.

Why It Matters: Built for Africans by Africans

Clauda was designed with the African developer in mind. We know the realities of building in Nigeria, Ghana, Kenya, and beyond. That’s why every part of our Direct Debit stack solves local pain points:

1. Instant Sandbox Access

Start building today. Clauda provides a fast and ready sandbox so you can test integrations before going live. Whether you’re building a custom financial app or a remittance engine, we help you ship faster.

2. Built-In Compliance Tools

We know compliance is hard. So we’ve integrated KYC/KYB checks directly into the API — with global coverage. That means fewer delays, faster onboarding, and regulatory peace of mind across borders.

3. Seamless Integration

Use one set of credentials to access Direct Debit in all three regions. Our API documentation is clean, easy to understand, and made for engineers — not just banks.

4. Local Support, Global Reach

Clauda is African-led. Our customer success team understands the market, speaks your language, and helps you troubleshoot in real-time.

What You Can Build with Clauda Direct Debit

Our API isn’t just infrastructure — it’s a toolset for product builders. Some of the most common use cases Nigerian and African startups are exploring include:

- Cross-border remittance platforms: Debit a user’s bank account in the US and send funds to Nigeria instantly.

- Digital savings apps: Set up recurring debit instructions to pull funds from diaspora users every month.

- Crypto platforms: Allow US/EU/UK users to fund their crypto wallets via their local bank accounts.

- Subscription SaaS: Let your global users pay for software or services via direct debit, even if you’re based in Lagos or Nairobi.

And because it’s all via API, you can deeply integrate Clauda into your backend and automate the entire flow — no manual steps, no third-party logins, no friction.

Real-World Example: Remittance Powered by Direct Debit

Imagine this scenario:

A Nigerian startup wants to allow families in the US to send money home to Nigeria directly from their US bank account. Instead of relying on cards or third-party wallet apps, they use Clauda’s ACH debit API.

- The user signs up, verifies identity through Clauda’s Identity API.

- Links their bank account securely.

- Authorizes a debit of $500.

- Clauda processes the debit via ACH and pays out instantly to a Nigerian bank via NIP.

This entire experience takes place on the startup’s app — Clauda powers it invisibly in the background.

The result? A world-class user experience. A fast-growing business. And a faster path to profitability.

Security and Trust at the Core

Payments require trust. Clauda is built with bank-grade security infrastructure. All data is encrypted end-to-end. We follow strict anti-fraud and AML protocols and maintain strict partnerships with licensed institutions across the globe. Your data and your users are protected at every step.

Pricing and Business Model

Clauda offers transparent, usage-based pricing with tiered plans to support businesses at all stages — from startup to scale-up. No hidden fees. No long-term contracts. Just pay for what you use.

Need FX hedging, compliance services, or additional tools? We offer optional add-ons to keep you flexible and compliant as your operations grow.

Get Started with Clauda

We believe African developers deserve better tools to compete globally. Clauda’s Direct Debit API opens new doors for startups across the continent — helping you receive payments from the world without the usual stress.

Start building smarter financial products with Clauda today.

- Website: clauda.co

- Email: hello@clauda.co

- Book a Demo: sales@clauda.co

Let Clauda help you take your product global — from Lagos to London, Nairobi to New York.